Following one of the most contentious presidential elections in U.S. history, it is easy to overlook that Donald Trump and Hillary Clinton agreed on one important workplace issue: For the first time, both the Democratic and Republican candidates put forth proposals supporting national paid family leave.

Perhaps that’s a reflection of the fact that most Americans—regardless of where they fall on the political spectrum—favor a paid and universally mandated family-leave law, according to the National Partnership for Women and Families. Currently, the United States is the only developed country in the world that doesn’t guarantee time off for parents and other caregivers at the federal level.

Until recently, states and cities generally didn’t offer paid parental leave either, but that has been changing. New York passed the most generous state-backed family-leave policy to date in 2016. The law allows for up to 12 weeks of paid time off for new parents to bond with their child (including an adopted or foster child) and permits the same leave to anyone who needs to care for a family member with a serious medical condition or to handle responsibilities for a spouse, child or parent called to active military service.

California, New Jersey, Rhode Island and Minnesota have paid-family-leave policies as well, as do San Francisco and Montgomery County, Md. In addition, legislators in Washington, D.C., passed a generous paid-leave law in December 2016.

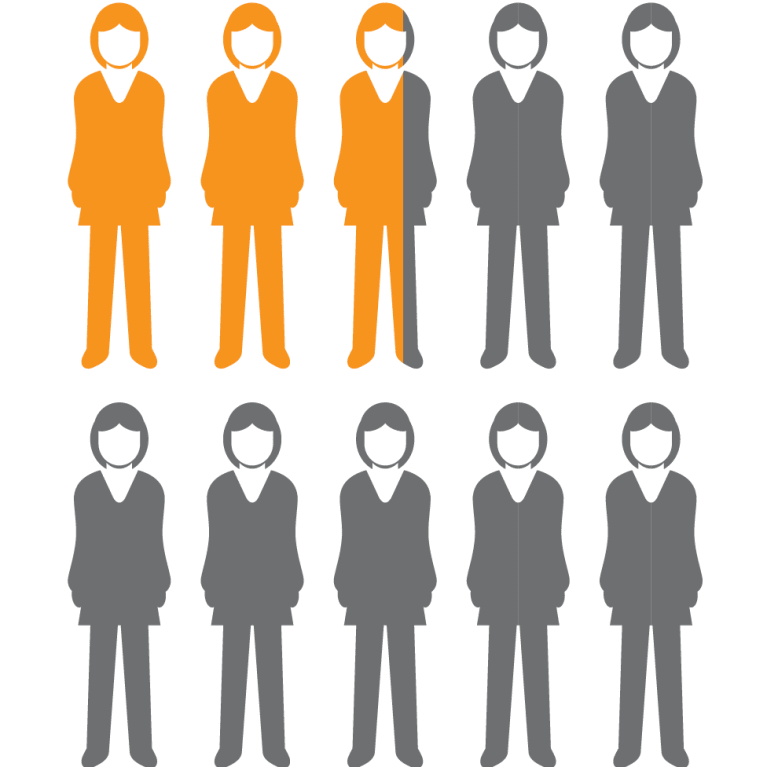

27% of women have quit a job due to familial responsibilities. Source: Pew Research Center.

At the same time, quite a few large companies, including American Express, Deloitte, EY (formerly Ernst & Young), Campbell’s and Etsy, among others, recently rolled out or expanded their paid-leave plans—by extending the time people are allowed to take off, increasing the number of eligible individuals or expanding the scenarios included in the coverage.

Given the recent momentum toward more-generous family-leave policies in both the public and private sectors, it’s reasonable to ask: Is the U.S. finally moving toward a workplace that is more supportive of caregiving?

Maybe—but change won’t happen overnight. After all, several family-leave bills introduced in Congress over recent years stalled due to the costs associated with them or because they were deemed unfriendly to employers. Most legal experts expect President Trump’s proposal to meet a similar fate.

And despite widespread public interest—particularly from younger workers in the

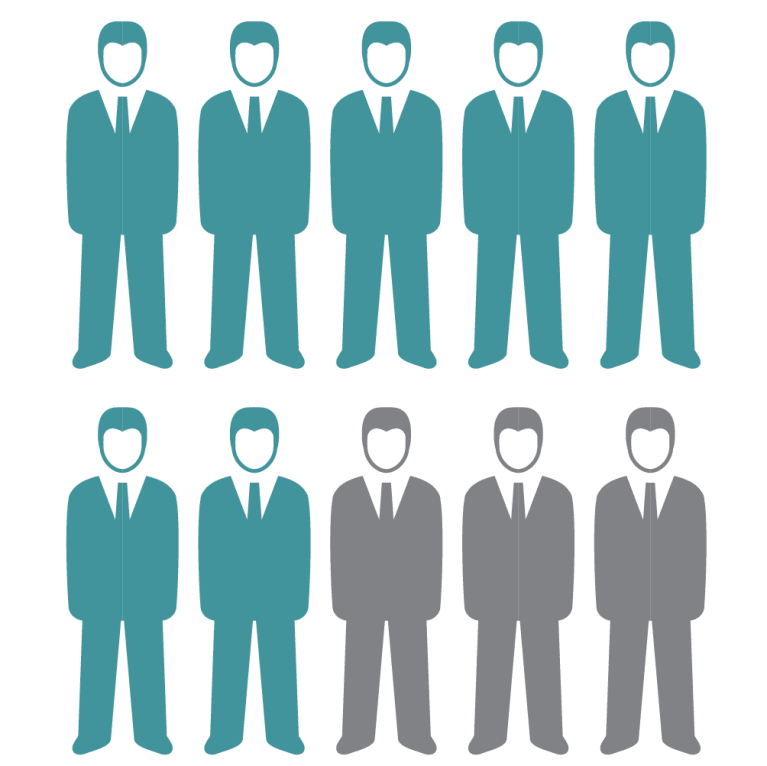

7 in 10 fathers who used paternity leave availed themselves of only 10 days or less. Source: Department of Labor policy brief.millennial generation—in evolving leave models to support caregiving, only 17 percent of employers offered paid parental leave in 2016, according to

2016 Employee Benefits, a research report from the Society for Human Resource Management (SHRM).

“I think we are in the beginning stages of [a shift toward paid leave], but America still has a long way to go compared to countries in Europe,” saysAlionna Gardner, an HR generalist/consultant withKiwi Partners Inc., an HR consulting firm in New York City with 50 employees. “Employers are starting to realize the importance of the working family and the significance of accommodating their needs.”

The President's Plan

Trump campaigned on the promise to bring six weeks of paid maternity leave to working mothers. Under Trump’s policy, new moms would receive 46 percent of their salary during the time off, paid for by reducing waste and abuse, such as overpayments, from within the unemployment insurance system. The plan would apply only to women who have undergone childbirth.

While Trump’s proposal has been criticized for excluding adoptive parents and fathers, even its opponents concede that it is a step in the right direction.

“I’m happy that he’s talking about it because traditionally Republicans haven’t,” says Aparna Mathur, a resident scholar of economic policy studies at the American Enterprise Institute, a nonpartisan think tank based in Washington, D.C.

However, Trump’s suggested funding source—using monies freed up by reducing waste—is not sustainable, Mathur says, because there are likely only a limited number of areas where expenditures can be reduced in the unemployment insurance system.

‘Employers are starting to realize the importance of the working family and the significance of accommodating their needs.’

—Alionna Gardner, Kiwi Partners Inc.

It’s important to structure any government-mandated benefit in a way that is not a burden on businesses, particularly small companies, according to Mathur. One possible funding mechanism could be via a minimum increase on employee payroll taxes, she says. Another might be to cut spending elsewhere or to reduce inefficiencies in other government programs.

Trump’s proposal will likely be discussed, negotiated and updated among lawmakers, yet chances are it will ultimately stall, just as the Democrats’ Family and Medical Insurance Leave Act did four years ago. That plan would have provided partial income to workers taking family leave.

“I don’t think [Trump’s plan] is going to be approved as is,” Mathur says. “I don’t think he has thought through a lot of the policy. The real sticking point will be how he convinces Republicans to go along with it.”

Most legal experts share that assessment. “There is practically no chance for bipartisan support of a paid-leave law coming out of Congress,” predicts Mark Kisicki, an attorney with Ogletree Deakins in Phoenix. “The only paid leave House Republicans might support would be an amendment to the FLSA [Fair Labor Standards Act] that would allow some type of compensatory time that employees could earn—at 1.5 times their regular hourly rate [for example]—by working overtime but electing to not be paid and, instead, banking those hours for future use as paid family leave.”

Changing Family Dynamics

Fathers may have something to say about Trump’s moms-only parental-leave plan. Recent Pew data indicate that roughly 2 million men in the United States are stay-at-home dads.

Yet leave options haven’t kept pace with shifting family dynamics. Seven in 10 fathers who used paternity leave availed themselves of only 10 days or less, typically for economic reasons, a gap in policy or an unsupportive work culture, according to a recent Department of Labor policy brief titled "Paternity Leave: Why Parental Leave for Fathers Is So Important for Working Families.”

Moreover, at companies that provide paid leave to new parents, mothers still receive nearly twice as many days as fathers (41 versus 22, respectively), according to SHRM’s 2016 Employee Benefits report, indicating that paid leave remains built around the assumption that women will take on most of the child care duties in the first weeks of parenthood.

There’s a generational component shaping employees’ evolving expectations as well. “Millennials and Baby Boomers are our largest living generations. Millennials and Generation Z are said to value work/life balance and flexibility just as much as, if not more than, health care,” says Jennifer Thornton, director of human resources at Terakeet, a Syracuse, N.Y.-based company with 165 employees that focuses on engagement marketing technology.

Only 17% of employers offered paid parental leave in 2016. Source: SHRM 2016 Employee Benefits research report.

At the same time, the aging of the massive Baby Boomer generation is also driving change—and redefining the scope of what family leave entails, as more workers look to take paid time off to provide elder care or to recover from their own illnesses.

Indeed, when Deloitte announced its 16-week paid-family-leave plan in September 2016, it made headlines for its decision to cover a broad array of caregiving scenarios, ranging from bonding with an infant to caring for an infirm spouse, significant other or parent.

“I think employers should place a greater importance on the things that are important to their people,” Thornton says. “That may vary based on demographics, culture, etc., but the need for leave to focus on caregiving seems to be a recurring theme among Americans.”

Creating a Caregiving Culture

At the state level, job protection isn’t written into existing family-leave laws. That means many low- and middle-income workers in easily replaceable positions worry that they will be let go if they take the full leave the government provides, Mathur says.

“Some people feel that they have to get back to work sooner because their career depends on it,” says Laura Kerekes, chief knowledge officer at ThinkHR, a company with a staff of 100 that offers HR software platforms. Headquartered in Pleasanton, Calif., ThinkHR consults with organizations of all sizes, from those with fewer than five employees to those with thousands.

This may be where HR professionals can make a real difference. They not only can encourage their companies to consider offering paid leave but also can work to create cultures that embrace caregiving. After all, it ultimately makes no difference whether a company offers time off if employees are too scared to use it, experts say.

“HR has to be the leader in the evolution of parental leave in America,” Gardner says. “We are the glue that holds businesses together and, more importantly, the catalyst that invokes change in policy and organizational development. Offering paid leave is a strategic move that allows businesses to become increasingly competitive.”

48% of men working full time reported that job demands interfered with family life. Source: Pew Research Center.

It’s that kind of thinking that led EY, which has more than 230,000 global employees, to boost its U.S. paid parental leave to cover 16 weeks for new moms and dads, including time off for birth, adoption, surrogacy or legal guardianship, according to Nancy Altobello, the consultancy’s global vice chair of talent.

That coverage is up from 12 weeks for new birth mothers and six weeks for dads and adoptive parents. The London-based company also increased its benefits for fertility treatments, surrogacy and adoption to make it easier for employees to manage their family needs. “I think we were a trendsetter here. We were out in front. Our policy was bold,” Altobello says. “We are all looking for the same great talent.”

Leaders at EY decided to improve the organization’s family-leave offerings after conducting surveys among its mostly Millennial workforce, while also reviewing and sponsoring studies on the benefits of offering paid parental leave.

“We did analysis, we built a business case, and we built support,” Altobello explains. “We did what we did based on what people want. Everyone needs to do what works for them.”

Terakeet took a similar approach. As a result of studying what its employees value most, the company recently adopted a policy that covers any employee eligible for job-protected leave under the Family and Medical Leave Act (FMLA). The plan includes up to eight weeks at full salary and an additional four weeks at 50 percent pay, with the option to supplement the difference with traditional paid time off.

The company’s leaders monitor workers’ needs continuously to create what Thornton calls a “culture of feedback,” enabling them to nimbly adjust offerings accordingly. “We send out surveys; we conduct ‘ask-me-anything’ sessions facilitated by all levels of leadership; we meet regularly with midlevel managers to solicit feedback; we ask what is working and what is not,” Thornton says.

“Of course, we hope that the dollar value of employee retention and engagement outweighs the cost of the benefit, but, more importantly, we want to demonstrate to our team, in tangible and relevant ways, that their values are our values,” she adds.

‘[Small employers] have the ability to offer flexibility to their workforce in ways that perhaps some larger companies cannot.’

—Gerri Burruel, McKesson Corp.

Kronos, a Chelmsford, Mass.-based company that specializes in workforce management, recently rolled out a policy providing paid maternity leave for 12 weeks, paid paternity leave for up to four weeks, adoption leave for four weeks plus up to $3,000 per child in adoption assistance, and up to $750 for child care financial assistance for some employees.

“The American workplace is placing a greater importance on people,” says Dave Almeda, chief people officer at Kronos, which has over 5,000 employees. “One of the ways that is showing up is in the area of caregiving and other benefits. I don’t think this [allows for] a one-size-fits-all approach. The benefits that companies choose to add will be directly related to the personas that they are trying to attract, engage and retain.”

Options for Small Businesses

The changes across the large-business landscape are undeniable. What’s less certain is what all this means for small and midsize companies. They also need to attract and retain top talent, but most lack the resources to roll out comprehensive leave plans. For many, offering unpaid time off to new parents is challenging enough, let alone footing the bill for it.

Fortunately, leaders in these companies need not make an either/or choice between offering a robust leave plan or doing nothing. The key for small businesses, workplace experts agree, is to build balance into their cultures.

“The smaller companies with lesser financial resources can find ways to be flexible and support their families in a way that works for them,” says Gerri Burruel, vice president of health and wellness for McKesson Corp., a health care services and information technology company headquartered in San Francisco.

While McKesson is not small—it has 70,000 employees worldwide—Burruel believes that modestly sized employers can take advantage of the adaptability that often comes with smaller staff sizes. “It may not be in a formalized family- or parental-leave policy,” she says, “but [small employers] have the ability to offer flexibility to their workforce in ways that perhaps some larger companies cannot.”

That might include novel approaches to telecommuting and other flexible schedules such as working longer but fewer days. “Some of our smaller clients are really getting more creative about allowing employees to flex their time and schedules to be supportive of their needs,” Kerekes says.

A good place for small-business owners to start is to conduct an analysis comparing the cost of various flexibility and leave options against that of turnover. The median cost to replace a worker is roughly 21 percent of his or her annual salary, according to a 2015 report from the Department of Labor titled "The Cost of Doing Nothing: The Price We All Pay Without Paid Leave Policies to Support America’s 21st Century Working Families."

Smart workforce planning is also key. “I explain to … my clients that paid leave only becomes an additional cost if we need to hire someone to replace the person while on leave,” Gardner says. “However, if the employee and the employer both take the proper steps and plan, the workload can be divided and projects can be scheduled according to someone’s leave of absence. Many small businesses [that] take the right steps can then absorb the effects of a few weeks of leave.”

Who’s Paying for What

A sampling of companies offering generous paid leave to new parents:

Dawn Onley is a freelance writer based in Washington, D.C. Illustration by David Vogin for HR Magazine.

**** **** **** ***** *****

Source: The Society for Human Resource Management (SHRM): https://www.shrm.org/hr-today/news/hr-magazine/0317/Pages/is-paid-family-leave-becoming-a-new-standard-for-employers.aspx